Because flipping shouldn't be a gamble, it should be a strategic game you can win

Meet Laquita Brooks The Flip Guru

EXPERT REAL ESTATE INVESTOR

With over 20 years of experience as a real estate investing frontrunner, Laquita has witnessed (and helped her clients overcome) every flipping struggle imaginable. Laquita has a proven track record of buying properties, renovating them to perfection, and flipping them for profit.

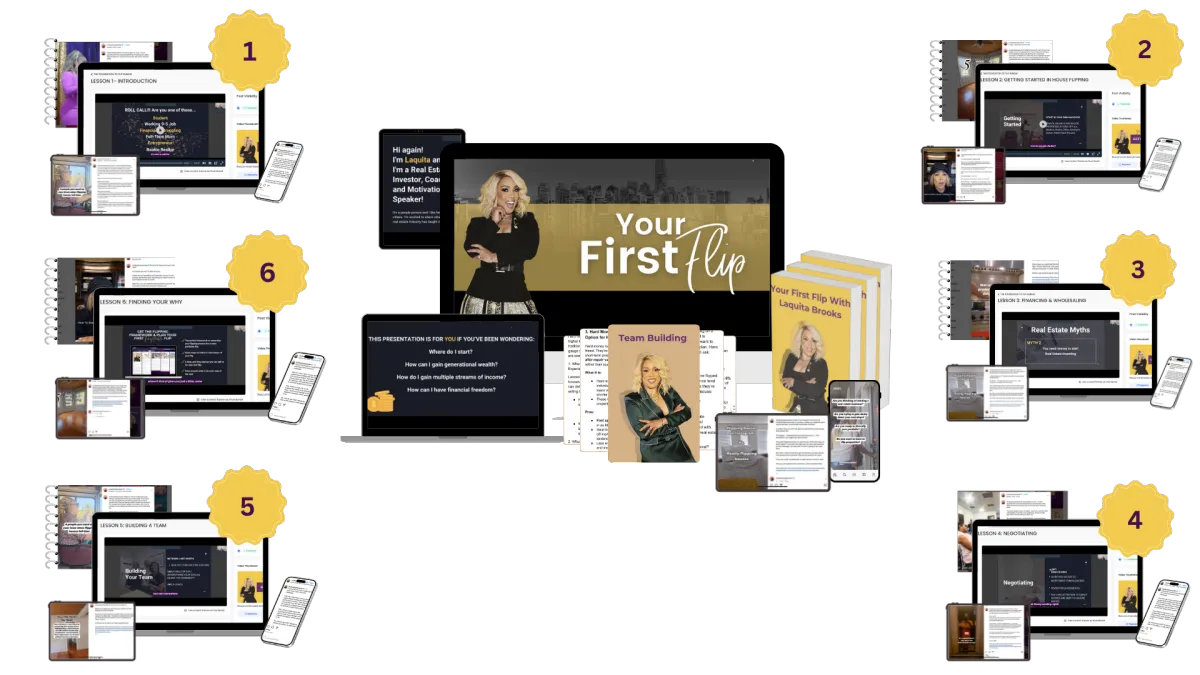

Get the Flipping Framework and Plan Your First Flip

Real Results

"She knows how to get things done and her business experience is exceptional. She’s an amazing coach and her advice is golden."

- S. Lavenia

"Working with Laquita was the best decision I ever made. The roadmap she provided me with for my real estate goals was such a help!"

- J. Davis

"She got me with no license required! I always loved the thought of flipping homes but thought I needed a license...NOPE! Thanks Coach Laquita for everything!"

- Q. Knowles

Stop Waiting - Do it Now!

Book a One on One Coaching Call with Laquita

I started lorem ipsum dolor sit amet, consectetur adipisicing elit and have since been able to lorem ipsum.

Ever since I've been able to lorem ipsum dolor sit amet, consectetur, including some cool stuff like:

Get Help with starting your real estate business

Gain clarity about our next steps

Learn to flip properties

Develop sound strategies to growing and diversifying your real estate portfolio.

Get in Touch

Your Paragraph text goes Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae. here

COMPANY

CUSTOMER CARE

LEGAL

FOLLOW Me

Copyright © 2023 Laquita Brooks. All rights reserved.